Undoubtedly, the cryptocurrency market is becoming highly susceptible to pump-and-dump schemes since the rules for it are unclear and harder for regulators to enforce. As a result, it becomes important to understand how a pump-and-dump scheme works in the crypto market and other related things.

What Is Pump And Dump Scheme?

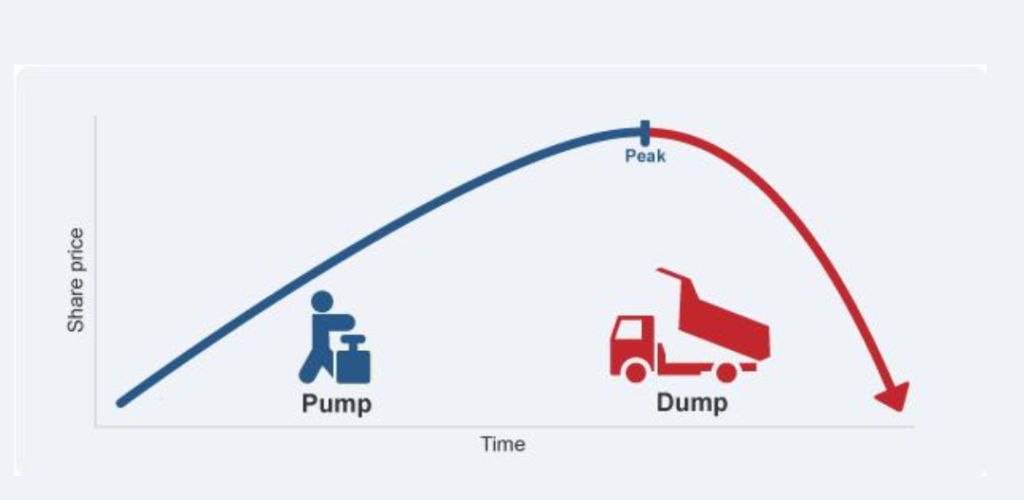

The “ Pump and Dump “ schemes involve artificially inflating the prices of a crypto asset through false and misleading information that seems positive. Once the high prices for the assets are pumped, the originator sells their stake and leaves the price crashing afterward. The scams originating from Pump and Dump scams have been around since the conception of market securities. Based on the falsely pumped information in the market when more investors pile into the assets the prices for the asset start rising and after its fully pumped, it drops down significantly. Thus, Pump – and – Dump schemes are a type of fraud.

How Pump And Dump Scheme Works?

There are dozens of crypto exchanges making it relatively easier to issue a new cryptocurrency in the market. As a result, it has become a breeding ground for such unregulated digital assets which are prone to scams.

Typically, it starts with the organizer gathering the influencers in some private group online and starts coordinating with them for buying the target crypto asset to avoid price hikes. Once the asset becomes ready to be pumped, the influencers start sharing information about its trading and attract followers on social media. This is when the originator or organizers coordinate the sale. Since launching crypto assets only requires a bit of research and coding knowledge therefore there are hardly any barriers to entry.

Components Of Pump And Dump Scheme

The entire mechanism of the Pump And Dump Scheme work in layers, where the highest profit is enjoyed by the innermost member of the group. Popularly, these layers include Organizers, Paid Inner Circle, and Inner Circle followed by Paid Outer Rim, Outer Rim, and the Final Participants.

The Inner Circle

The organizers and members from the inner circle benefit quite a lot and tend to buy coins well in advance when the prices are lower. However, their success rate can also vary because of the reasons such as – wrong timing, technical issues, or another unexpected glitch while making purchases. Generally, it only takes a few minutes for Pump and Dump scheme to reach the outer members of the group.

Broadcasting Phase

At this point, the organizers create an alert for members about an upcoming pump. The frequency varies quite a lot as it may happen several times in a week or even a day. The countdown is set for creating excitement and awareness for the Pump. The Pump and Dump take place in the selected exchange, these are generally smaller exchanges in most cases as their lower volume makes the market movement quite speedy.

Pump Phase

Here organizers buy their load at the earliest to receive the highest benefit from the price spike. After the purchase, the positive information about the coin is circulated at the mass level and then outer participants come into play and buy the coins. This phenomenon further expands the value of the coin and takes it to its highest.

Dump Phase

Now, the prices of the assets are at their peak and now the coins bought by the organizers at the beginning of the pumping process are sold and dumped. This in turn drastically reduces the prices of the assets and brings them back to their original or similar value.

How To Identify And Avoid Pump And Dump Scam?

There are a few fundamental behaviors of the assets and their related environment that help to identify the Pump And Dump in Cryptos.

- Research and observe if you come across any unknown cryptocurrency being touted on social media or exchanges by strangers. Avoid making a haste decision and look for its whitepaper and understand thoroughly. Determine its objectives, future prospects, and potential.

- Going further, if you see the token has been around for a while but development on the projects seems to be missing then avoid it. Any projects with an unclear purpose are a big red flag.

- If you observe the long–time influencers in the finance space suddenly starts talking about specific cryptocurrency in a way that sounds like a promotion. Ask yourself a few intelligent questions based on the research before taking any decision.

- Instead of relying on third-party information, head straight to the sources such as websites, whitepapers, or any other source that gives reliable information.

- If you observe the prices or orders for assets grow significantly, wait. Observe its pattern on trading volume and be cautious if there is a trending hike.

Final Words

Evidently, if you are not a part of the inner circle in the Pump and Dump scheme then this phenomenon can put in a great risk. Moreover, there isn’t a way to escape it either, all you can do is be cautious while investing and be excellent at research. Avoid anything or everything that you sense is suspicious.